In Part 2, we learned about F11 Features and F12 Configurations and how to create an Inventory. Now in this part, we will discuss voucher entries and other features of Tally.ERP 9.

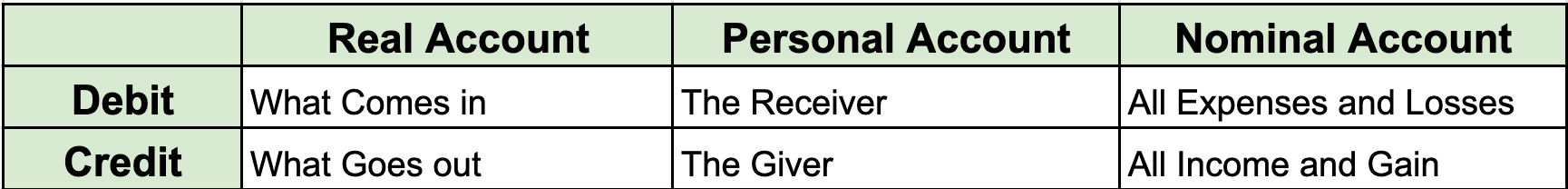

In accounting terms, a voucher is a document containing details of financial transactions that can be used later on for different purposes. Tally.ERP 9 follows the Golden Rule of Accounting.

Accounting Vouchers

Tally.ERP 9 is pre-programmed with various accounting vouchers, each designed to perform specific functions/jobs. There are 10 specific standard vouchers in Tally.ERP 9.

- Journal Voucher(F7)

- Receipt Voucher(F6)

- Payment Voucher(F5)

- Purchase Voucher(F9)

- Debit Note Voucher(Ctrl + F9)

- Sales Voucher(F8)

- Credit Note Voucher(Ctrl + F8)

- Contra Voucher(F4)

- Reversing Journal(F10)

- Memo Voucher(Ctrl + F10)

Journal Voucher (F7)

The use of the Journal Voucher is to adjust two accounts.

To create a Journal Voucher, go to Gateway of Tally > Accounting Vouchers > F7:Journal

The process is similar to what you do on a hard copy of a journal voucher. You can create vouchers according to Account Headings such as Cash, Furniture, Plant and equipment, et al., which needs two accounting headings at least.

Receipt Voucher (F6)

It records all the transactions of the receipt of money either by bank cheque or by cash.

To create a Receipt Voucher, go to Gateway of Tally > Accounting Vouchers > F6:Receipt

A receipt voucher allows you to document payments made by other parties to the company. It provides us with an insight into the regular and irregular paying parties. It is also the denotations of assurance that the payment is made to the right party on behalf of payers.

Payment Voucher (F5)

It records all the transactions of money paid either cash or by bank cheque.

To create a Payment Voucher, go to Gateway of Tally > Accounting Vouchers > F5:Payment

Purchase Voucher (F9)

You can record purchases of both goods and services simultaneously in the same ledger by selecting the required purchase ledger in a Purchase Voucher.

To create a Purchase Voucher, go to Gateway of Tally > Accounting Vouchers > F9:Purchase

Debit Note Voucher (Ctrl + F9)

A Debit Note Voucher is made when you return the purchase of goods.

To create a Debit Note Voucher, go to Gateway of Tally > Accounting Vouchers > Ctrl+F9:Debit Note

Sales Voucher (F8)

You can record sales of both goods and services in the same invoice by selecting the required sales ledger in a Sales Voucher.

To create a Sales Voucher, go to Gateway of Tally > Accounting Vouchers > F8:Sales

Credit Note Voucher (Ctrl + F8)

A Credit Note Voucher needs to be created when the goods sold are returned by the customer.

To create a Credit Note Voucher, go to Gateway of Tally > Accounting Vouchers > Ctrl+F8: Credit Note

Contra Voucher (F4)

A Contra entry is a transaction indicating a fund transfer from a bank account to the cash account, from a cash account to the bank account, and from one bank account to another.

To create a Contra Voucher, go to Gateway of Tally > Accounting Vouchers > F4:Contra

Utilities

Utilities consist of the importing of data and the banking section. The Banking features enables business owners to perform a host of bank-related activities, including payments to the parties, bank reconciliation and cheque management. It provides an end-to-end solution to the banking needs for running the company.

The data can be imported following the given steps.

- Go to

Gateway of Tally>Import of DataOr Press Alt + O (Input) >Masters - Enter the name of .xml file to be imported.

- Press Enter to import

Reports

When clicking Report from the Gateway of Tally, the report menu will be displayed. We can modify the display to meet or suit the requirements by choosing the correct buttons from the button bar. This section includes the Balance sheet, Profit and Loss Account, Stock Summary and Ratio Analysis.

Balance sheet

It is a financial statement that shows the financial position of the company. The balance sheet follows the fundamental accounting equation: Assets = Liabilities + Owner's Equity.

To view the balance sheet of a company,

- Go to

Gateway of Tally>Display>Balance sheet - Press F12 to configure the Balance Sheet

- Press Ctrl + A to accept

Profit and Loss Account

Profit and loss are the company's financial statements that show the company's revenue and expenses during a particular period. The Profit and Loss Account in Tally.ERP 9 displays information based on default primary groups. It is updated with every transaction/voucher entered and saved in the system.

It can be viewed in Tally.ERP 9 for a specified period.

- Go to

Gateway of Tally>Display>Profit & Loss Account - Click F1: Detailed to view Profit & Loss Account.

- Press F2: Period to change the period as required.

Stock Summary

It is the statement of real-time stock-in-hand on a particular day. Tally.ERP 9 helps you know your stock summary, stock position, access value of your stock, a monthly summary of stock items, and stock voucher if you have maintained the inventory groups, transferred stock for various business purposes, and purchased and sold the stocks items.

The stock summary helps to know your stock's opening and closing balance in any specified period. It displays an item-wise summary – a list of stock items with corresponding closing balance details.

- For Stock Summary: Go to

Gateway of Tally>Stock Summary - For Knowing your Stock Position:

Gateway of Tally>Stock Summary>Alt + F7and Select Saleable Stock - To Assess Value of Stock Items: Press Alt + C (new column) and select the last sales price as the Method of Stock Valuation.

- Monthly summary of Stock Items: Go down from the stock summary report to open the monthly summary report at the stock item level. Press F4 and select stock item to view the month-wise closing balance of selected items.

- Monthly summary of Stock Voucher: Go down from the stock item monthly summary report on a particular month to open the Stock Vouchers Reports. Press F4 (Items)

Ratio Analysis

Ratio analysis is a powerful tool used for financial analysis. It is divided into two parts: Principal Group and Principal Ratios. The Principal Group gives perspective to the ratios, whereas the Principal Ratio relates two pieces of financial data to obtain a meaningful comparison.

Principal Groups and key features in Tally.ERP 9 includes working capital, cash in hand and bank balance, sundry debtors, sales and purchase account, stock in hand, net profit, inventory turnover (Sales Account/Closing stock) and working capital turnover (Sales Account/ Working Capital).

- To access Ratio Analysis, go to

Gateway of Tally>Ratio Analysis

The ratio analysis screen is displayed as shown below.

Analysis and Verification

The Analysis and Verification feature facilitates conducting internal analysis and verification of the company's financial data. Data analysis helps to identify exceptional areas and thereby ease the process of verification. To access this feature:

- Go to

Gateway of Tally>Analysis and Verification>Data Analysis

OR

- Press Alt + G > Select Data Analysis Report > and Press Enter.

This is the last part of the 3 part tutorial series about using Tally.ERP 9! I hope you enjoyed reading.