Using the taxpayer portal is not difficult if you know how to use it properly and what functions are available on the Inland Revenue Department (IRD) site. But if you lack information, then it might be a problem.

Therefore, let's know about the taxpayer portal and the documents required for getting personal and business PAN.

Who Are Taxpayers?

A taxpayer is a person, an organization or an entity obligated to pay taxes to federal, state or local government. The word 'Taxpayer' generally characterizes one who pays taxes. A modern taxpayer may have a unique reference number or an identification number issued by a government. So, a taxpayer is a person or entity liable to pay a certain amount of tax to the government for the use of goods and services.

Taxpayer Portal

The taxpayer portal is an E-service which includes different services. The taxpayer portal has an Integrated Tax System section which consists of other sub-sections such as General, Registration (PAN, VAT, EXCISE), VAT, Estimated Return, Income Tax, Excise, Electronic-Tax Deducted at Source(E-TDS), Diplomatic Refund, Health Tax, Education Tax, Electronic Billing, Education Service Fees and Other Offices. Each sub-section has a unique function.

The taxpayer portal is shown below:

As we are all aware, the government of Nepal has made it mandatory for all the salaried workers or employees of both private and public companies to register and have a PAN from the last fiscal year, 2019/20. It is done to track the taxes paid by the citizens and revenue leakages. The different PAN categories are:

- Personal Permanent Account Number (P-PAN)

- Business Permanent Account Number (PAN)

- Withholding Permanent Account Number (W-PAN)

Documents Required to Obtain PAN

The following documents are required to make a permanent account number (PAN).

For Personal Permanent Account Number (P-PAN):

- In the case of Nepalese citizens, a copy of the citizenship certificate is needed.

- In the case of Indian citizens, an identity card issued by the government agency and an employer's recommendation letter is needed.

- In the case of foreign nationals other than Indians, a copy of their passport or identity card issued by the diplomatic mission, labour acceptance letter and employer's recommendation letter.

- One passport-sized photo.

- Application form with details.

For Business Permanent Account Number (PAN):

In the case of a natural person:

- A copy of the profession or business registration certificate issued by the initial registration body that registers the profession or business.

- A copy of their Nepali citizenship certificate.

- In the case of foreigners, a passport or identity card issued by a diplomatic mission (in the case of Indian citizens, a copy of their identity card issued by the government agency), labour acceptance letter and bank voucher for the deposit required by the tax officer considering the nature of transactions.

- Two passport-sized photos of the business owner.

- A photocopy of lalpurja if the business is held within your building, otherwise a copy of the home maintenance agreement with the landlord.

- A map made to show the main business locations is also required.

For Business Permanent Account Number (PAN) in the Case of an Entity:

- A copy of the partnership firm and company registration certificate.

- A copy of the work order agreement in case of a partnership firm.

- In the case of a joint venture (JV), copies of management deeds, regulations or statutes.

- Two copies of passport-sized photos of the person signing the application form.

- A copy of citizenship of all the partners in case of partnership firm or all directors.

- A copy of the decision of the board of directors or working committee of the company to take a PAN.

- A copy of lalpurja if the business is held within your building; otherwise, a copy of the home maintenance agreement with the landlord.

- A map made to show the main business place or head office.

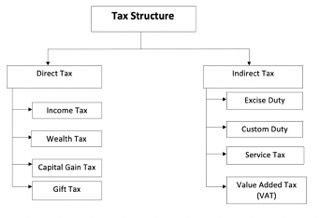

Tax is a mandatory fee or financial charge levied by the government on an individual or an organization. It is done to collect the revenue for public developmental work providing all facilities and infrastructures that improve their life. Hence, one should know about the tax structure clearly before paying it. The various structures of taxes in Nepal are shown below.

Online PAN Registration

We can apply for online PAN registration and get personal and business PAN. To get a PAN number, you need to go through the following mentioned steps:

Step 1: Go to the IRD website.

Step 2: Then click on Registration (PAN, VAT, Excise)

Step 3: Select Application for Registration

Step 4: Type username and password and click on the check box of PAN type that you want to register

Step 5: Select IRO/TSO, depending on where you want to collect your PAN and click the OK button

Step 6: Then fill in the detailed information after clicking the continue button

Step 7: An OTP will be sent to your mobile number or email after submission

Step 8: Enter the received OTP and submit it for verification

Step 9: After verification, your PAN number will be sent to your mobile and email

Step 10: Finally, when the verification from the office is completed, the PAN printing facility will be available after you log in

Displaying Pan Number Using Tax Plate

To disclose the status of a registered taxpayer, the taxpayer must issue a tax label that is visible at the taxpayer's place of business. The features of the tax plates, such as sizes and colours are listed below.

Size of the Plate

The length of the tax plate should be 30 centimetres, and the width should be 10 centimetres.

Details to Be Included

- Permanent Account Number (PAN)

- Taxpayer's Name

Colour of the Plate

The tax status of the taxpayers can be identified based on the background and colour of the tax label. The colour and the tax status are listed below:

Bush green background and letters in white colour: VAT registered taxpayers.

Lemon yellow background and letters in black colour: Taxpayers dealing in goods and services subject to VAT but whose transactions do not reach the threshold, i.e. two million rupees per annum.

Signal red background and letters in red colour: Taxpayers dealing in non-taxable goods and services.

Viewing Records and Updating KYT

Furthermore, taxpayers with personal and business PAN through online services can also record and update know-your-transaction (KYT). For that, we need to follow the mentioned steps.

Step 1: Log in to ird.gov.np

Step 2: Click on the Taxpayer Portal

Step 3: Click on the Taxpayer Login from the General Menu

Steps 4: Enter your PAN, user ID and password (If there is no user ID, Password or if it is forgotten, you can Create/Reset your user ID and Password)

Step 5: Click on the KYT link

Step 6: Fill in the information shown on the screen

Step 7: Click the save button

Step 8: Verify it by inserting OTP sent to your mobile or email

Now you definitely know how to use the Taxpayers Portal to register any PAN online and use the online website to check your tax records through this article.

Subscribe to our blog and please leave a comment below!